Is Keeping Money From A Bank Error Illegal

It sounds similar a dream: Checking your bank rest to find it higher, much higher, than it should be. Only it tin — and does — happen. American consumers have seen bank mistakes in their favor for thousands and even hundreds of thousands of dollars.

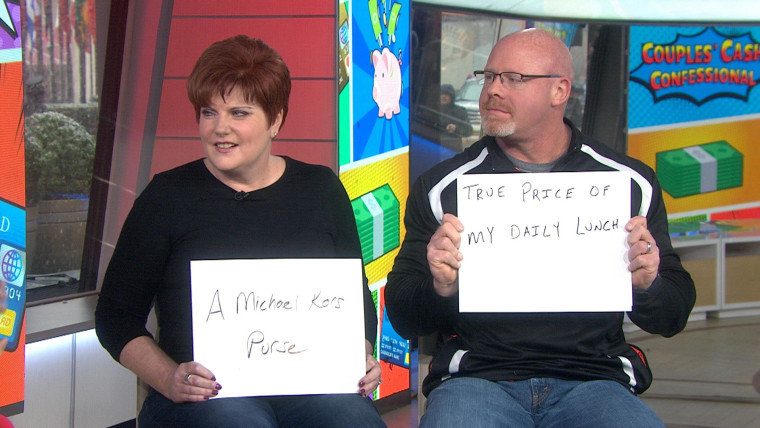

"I felt similar I was in a Monopoly moment," Leslie Holland told NBC about opening a statement from her brokerage account to meet $23,000 that wasn't hers. "Like getting the card that says banking company error in your favor: Collect $200."

Tin can You Go on It?

"You do have that moment of 'Oh my God, I won the lottery,'" said Holland, a marketing executive in Louisville, Kentucky. She didn't call her bank immediately. "I was walking around in windfall shock. Y'all think about 'Can I keep it?'"

Mike Lieberman had the aforementioned thought after the sale of his Brooklyn apartment in 2014. Afterward he signed over his gain to a visibly tired teller, he noticed the deposit slip showed a mistake in his favor — to the tune of $700,000.

"It's weird," he told NBC News. "Like in a film when you see something happens to a person and a million things run through their mind in a carve up second. I looked at it [and idea] 'Holy cr*p, this is really not right. Can I go along it, tin I spend information technology, can I invest information technology and give it back before anyone notices?' This all goes through your caput really fast."

Industry insiders insist that while mistakes do happen, they are very few compared to the billions of successful transactions carried out every day.

"We conduct billions of transactions on a daily footing that are correct on both sides," said Doug Johnson, senior vice president for payments and cybersecurity policy at the American Bankers Association. But "there'due south ever the potential for human error."

Here'due south the Bad News

And when mistakes are fabricated, "'Don't keep it,' is the firm advice," Johnson said. "Eventually, the bank will come dorsum to the customer. Offset they'll reverse the transaction but too potentially generate a police study after effective research, significant the bank will contact the customer … and ask the logical questions: Did they notice that it was inadvertently deposited, why didn't they warning the bank, why didn't they return the funds. Information technology creates a whole confluence of events that are not attractive."

One Georgia teen learned this the difficult fashion. Subsequently spending $30,000 in his banking concern account that didn't belong to him, the beau earned a 10-yr sentence, according to local news reports. A teller had deposited a check from a client with the same concluding name into the teen's account; he spent most of the funds on a BMW.

Lieberman, a old neuroscientist, speculated on how a person might make such a bad conclusion. The same part of the brain that gives united states of america a rush when, say, we win a hand of cards, kicks in when nosotros confront a scenario like unexpected money, Lieberman suggested. The limbic organisation is like the rewards circuitry. "There's a lot of dopamine signaling ... your centre charge per unit goes up, your pupils dilate, you commencement sweating. That's when you make bad decisions. A lot of this is evolutionary response."

The pre-frontal cortex, which controls reasoning and judgment, is one of the concluding parts of the encephalon to fully develop.

"It takes grooming and learning and life experience" to non permit that quick rush override your judgment, said Lieberman. "I'm fortunate that I didn't do something stupid." After his split-second deliberations, Lieberman pointed out the $700,000 mistake to the teller.

Holland pointed out her bank's error, too. "At the cease of the solar day this isn't my coin and I kept visualizing a footling quondam lady who's missing $23,000. I'm glad my mother taught me right from wrong," she said.

How to Avoid the Dilemma

To avoid such situations, keep a close eye on your accounts.

"Manage your residue yourself in add-on to what your banking company is doing," Johnson said. Online banking may have made it easy to throw out the one-time fashioned check registers, just he uses his to reconcile his account to the penny, "even though I only write a check to the woman who takes care of our cats every two months." Software is besides available to double check the bank'southward figures. And at the teller line, look at the deposit slip as confirmation and verify it is the amount intended. Besides, Johnson said, double check remote deposits fabricated with phones.

"Information technology's really important in this world to protect yourself and to accept responsibility fifty-fifty though nosotros largely depend on financial institutions to practise that for us," Johnson said.

Nevertheless not convinced? Consider this: "Back to my cybersecurity paranoia, some measures aid customers in protecting from unauthorized transactions on the other side," he said. "You lot can definitely play a major role in the kickoff line of defense force."

Considering even if you lot're not in a hurry to report that big eolith, we would all want to know right away if coin's going out that shouldn't.

Source: https://www.nbcnews.com/business/personal-finance/bank-error-your-favor-can-you-keep-cash-n735316

Posted by: walleyvarom1999.blogspot.com

0 Response to "Is Keeping Money From A Bank Error Illegal"

Post a Comment